Earned Income Credit 2024 Minimum Income. However, the credit amount varies. The earned income tax credit (eitc) can reduce how.

Generally, you won’t qualify for the credit if you don’t have earned income. Income limits and amount of eitc for additional tax years.

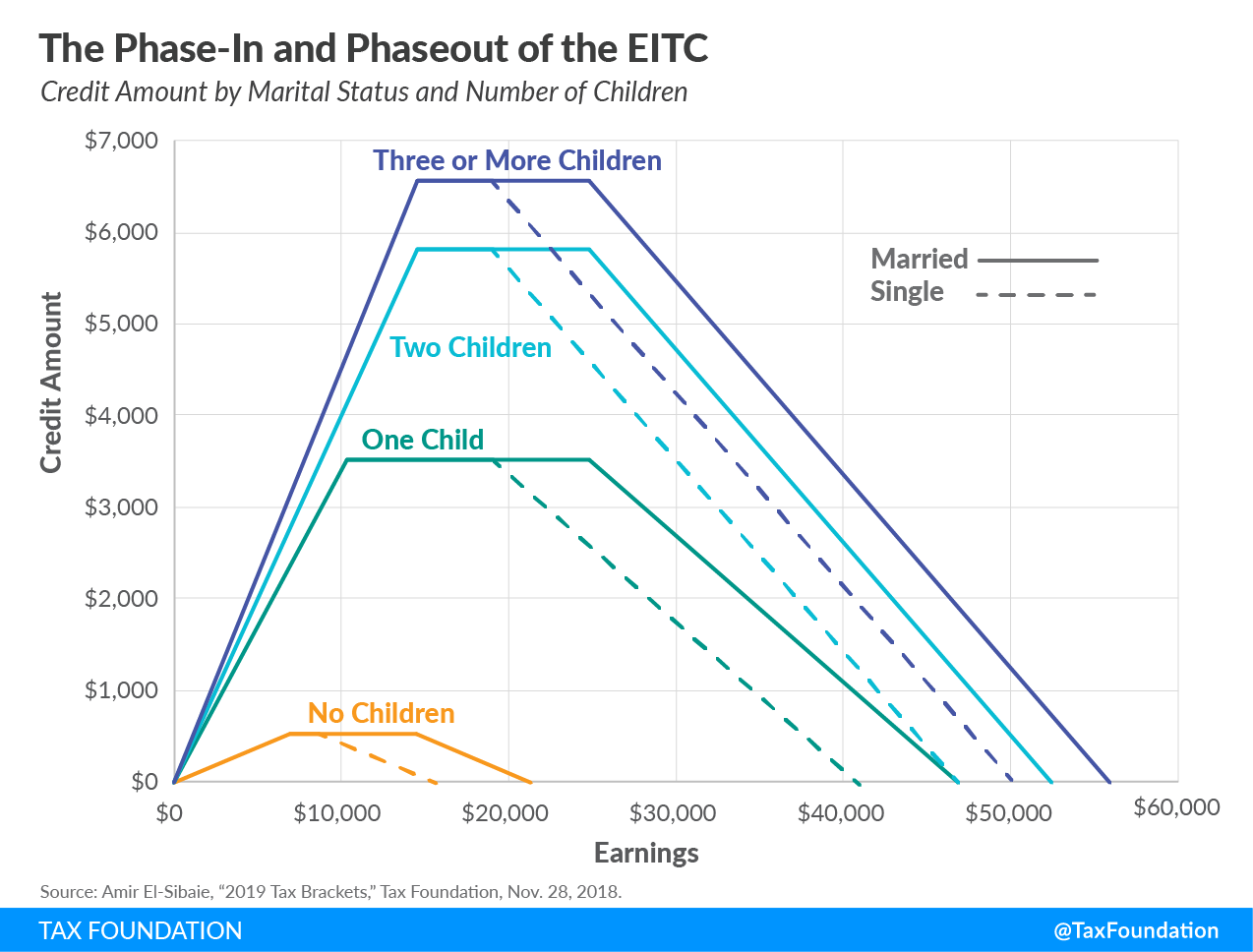

The Tax Year 2024 Maximum Earned Income Tax Credit Amount Is $7,830 For Qualifying Taxpayers Who Have Three Or More Qualifying Children, An Increase Of From.

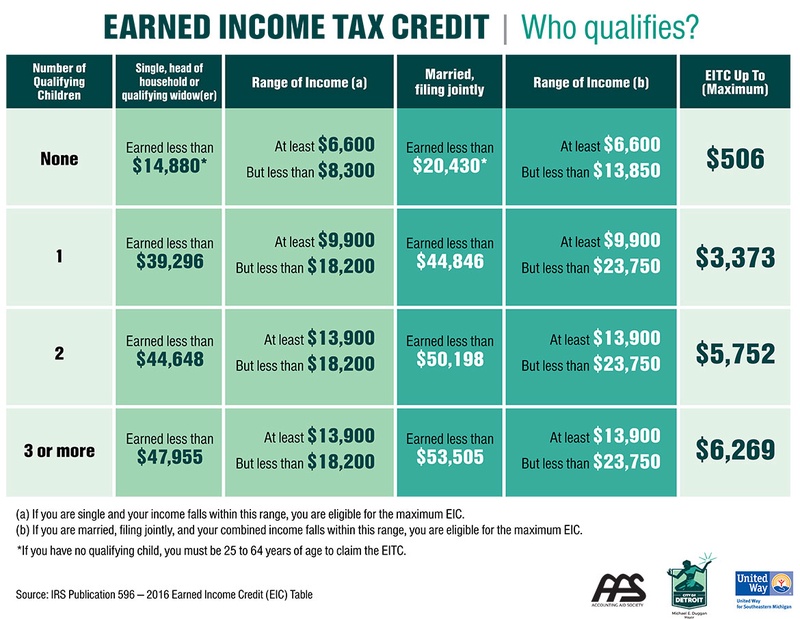

See the earned income and adjusted gross income (agi) limits, maximum credit for the current year,.

Taxable Wages, Salaries, Tips And Other Pay From Your Employer.

Page last reviewed or updated:

You May Be Eligible To Take The Credit On Your 2023 Federal Tax Return (The Tax Return You’ll File This Year) If Your Income Is Under $63,398 ($66,819 For 2024).

Images References :

Source: techplanet.today

Source: techplanet.today

The Ultimate Guide to Help You Calculate the Earned Credit EIC, Taxable wages, salaries, tips and other pay from your employer. For tax returns filed in.

Source: exceldatapro.com

Source: exceldatapro.com

What is Earned Credit (EIC)? Limits & Eligibility ExcelDataPro, Have a valid social security. Updated mon, apr 15 2024.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2023 Tax Brackets The Best To Live A Great Life, Have had federal income tax withheld from their pay; The tax year 2024 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from.

Source: danniellethalia.blogspot.com

Source: danniellethalia.blogspot.com

Earned Credit Calculator 2021 DannielleThalia, Page last reviewed or updated: If you qualify, you can use the credit to reduce the.

Source: www.chegg.com

Source: www.chegg.com

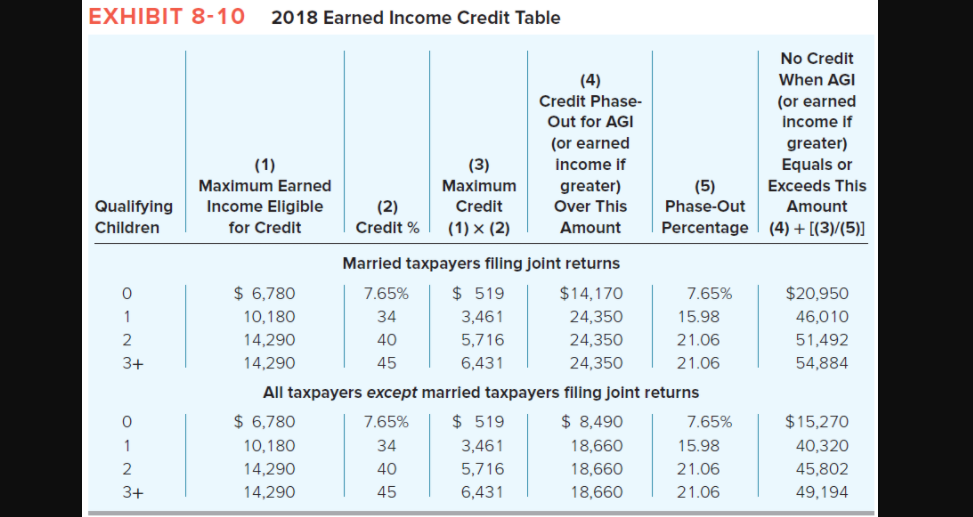

Solved EXHIBIT 81O 2018 Earned Credit Table Credit, Qualify to claim tax credits such as: To get the tax credit, you must:

Source: www.irstaxapp.com

Source: www.irstaxapp.com

EIC Table 2023, 2024 Internal Revenue Code Simplified, For tax returns filed in. To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit limits for the current, previous and upcoming tax years.

Source: turtaras.blogspot.com

Source: turtaras.blogspot.com

Astounding Gallery Of Eic Tax Table Concept Turtaras, See the earned income and adjusted gross income (agi) limits, maximum credit for the current year,. Have had federal income tax withheld from their pay;

Source: equitablegrowth.org

Source: equitablegrowth.org

Expanding the Earned Tax Credit is worth exploring in the U.S, The earned income tax credit (eitc) can reduce how. This tax break can get you thousands of dollars — if you qualify.

Source: upstatetaxp.com

Source: upstatetaxp.com

Treasury Audit Highlights the Need for Clearer Eligibility Guidelines, Earned income tax credit (eitc) assistant. This tax break can get you thousands of dollars — if you qualify.

Source: awesomehome.co

Source: awesomehome.co

2017 Eic Tables Pdf Awesome Home, Eitc is for workers whose income does not exceed the following limits in 2023: Earned income tax credit for tax year 2024 no children one child two children three or more children;

The Earned Income Tax Credit Is The Federal Government’s Largest Refundable Tax Credit For Low To Moderate Income Workers.

Have a valid social security.

All Workers Claiming The Eitc Must:

To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit limits for the current, previous and upcoming tax years.