Gift Amount Per Year 2024. $ value of gifts given before 2024: Value of gifts given in 2024:

2024 gift tax exemption limit: The combined gift and estate tax exemption will be $13.61 million per individual for lifetime.

But Even If You Exceed That Amount, There Are Some.

This means a parent can give $18,000 to one child and another $18,000 to another child without having to file a gift tax return in 2025, according to personal finance.

The Lifetime Gift Tax Limit For 2024 Is $13.61 Million, Up From $12.91 Million In 2023.

Ordinary monetary and property gifts are unlikely to be impacted by this tax, since the yearly limit for 2024 is $18,000 per giver per recipient.

Also Any Gift Of Other Than Relatives (Eg.

Images References :

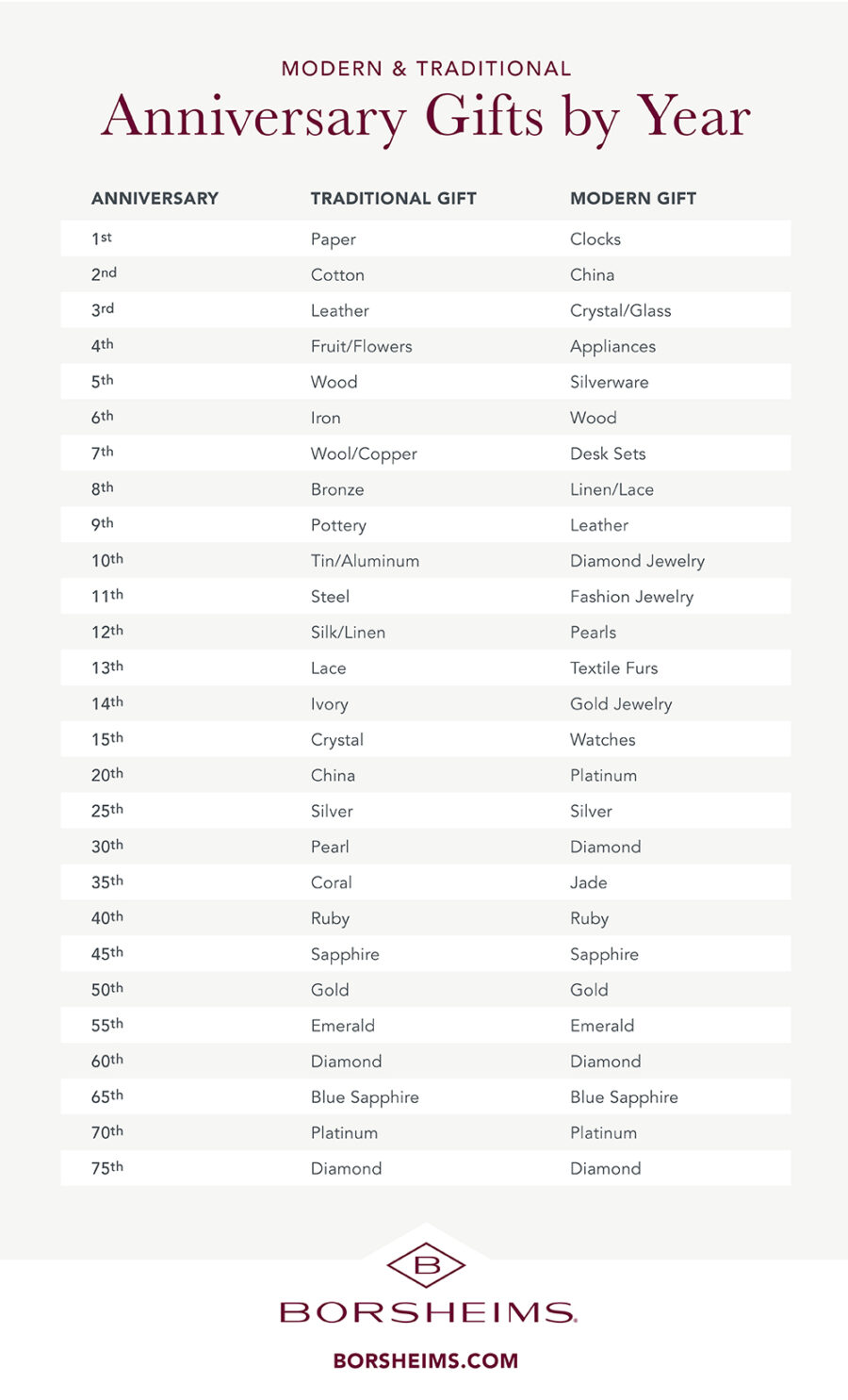

Source: www.borsheims.com

Source: www.borsheims.com

Your Guide to Modern & Traditional Anniversary Gifts by Year — Borsheims, This means you can give up to $18,000 to as many people as you want in 2024 without. (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.) for married.

Source: www.pinterest.co.uk

Source: www.pinterest.co.uk

Wedding Anniversary Gifts by Year Traditional Wedding Anniversary, Value of gifts given in 2024: Gifting a house property in india comes with important income tax and stamp duty considerations that individuals must take into.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

Navigating Fiscal Uncertainty Weak State Revenue Forecasts for Fiscal, But even if you exceed that amount, there are some. 20, 2018, the irs clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025.

[Solved] On January 1, 2024, Royal Paradise borrows 38,000 by agreeing, Such gift can be in cash or in kind. You’ll have to report any gifts you give above.

Source: www.pinterest.co.uk

Source: www.pinterest.co.uk

Idea 39+ Marriage Anniversary Card Theme Traditional anniversary, For 2024, the annual gift tax limit is $18,000. But even if you exceed that amount, there are some.

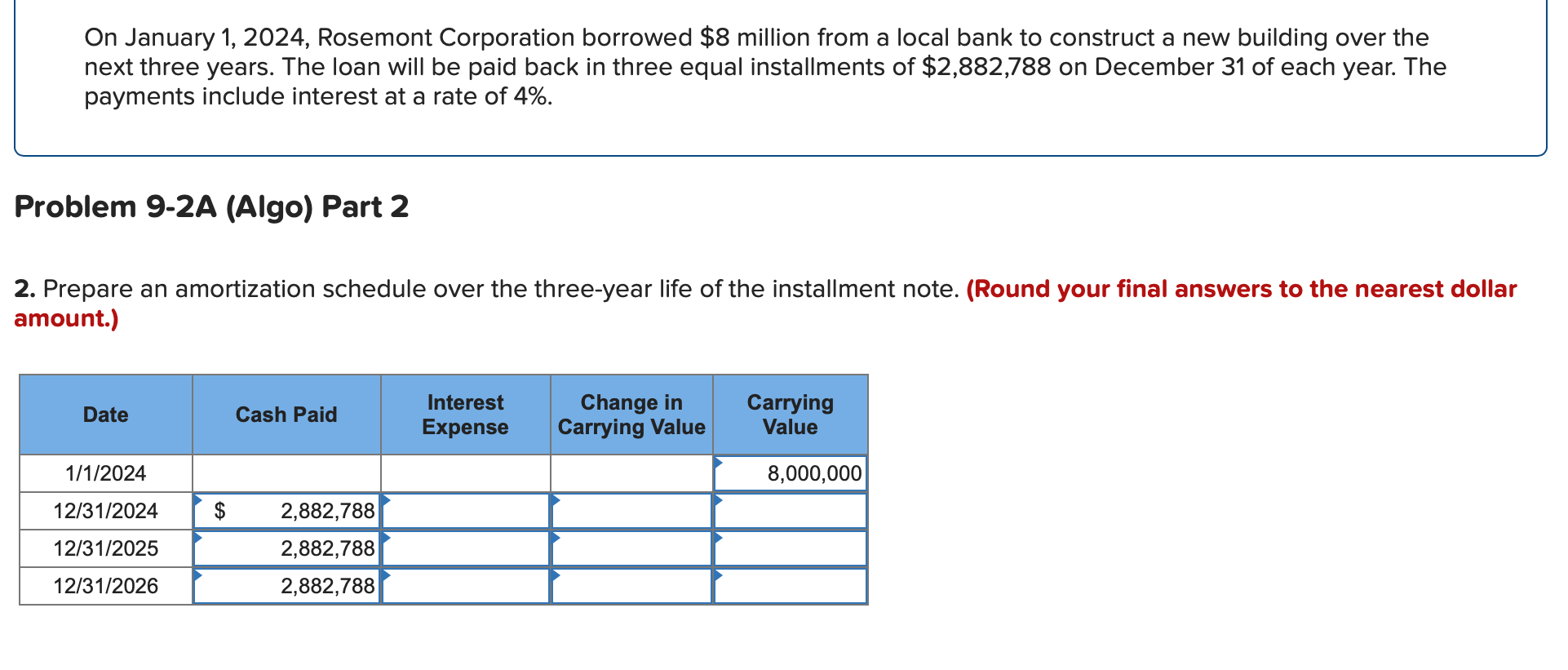

Source: www.chegg.com

Source: www.chegg.com

Solved On January 1,2024 , Rosemont Corporation borrowed 8, 2024 lifetime gift tax exemption limit: But even if you exceed that amount, there are some.

[Solved] Urgent!!!! I'm very very confused!!!! At the end of 2022, the, Indeed, in 2023, the annual gift exclusion amount is. 2024 gift tax exemption limit:

Source: www.theknot.com

Source: www.theknot.com

Wedding Anniversary Gifts by Year Traditional & Modern Themes, $ value of gifts given before 2024: According to the pib release dated february 10, 2024, “the board has recommended a distribution of historic income amount of rs.

Source: www.pinterest.com

Source: www.pinterest.com

Traditional and Modern Anniversary Gifts by Year www.memorablegift, You can give as many gifts of up to £250 per person as you want each tax year, as long as you have not used another allowance on the same person. The gift tax limit (or annual gift tax exclusion) for 2023 is $17,000 per recipient.

Source: www.pinterest.com

Source: www.pinterest.com

Wedding anniversary gifts by year What are the anniversary gifts for, The annual gift tax exclusion allows. Each year, the irs sets the annual gift tax exclusion, which allows a taxpayer to give a certain amount (in 2024, $18,000) per.

The Gift Tax Limit (Or Annual Gift Tax Exclusion) For 2023 Is $17,000 Per Recipient.

You’ll have to report any gifts you give above.

Friends ) Is Tax Free Upto Limit Of Rs 50,000.

Ordinary monetary and property gifts are unlikely to be impacted by this tax, since the yearly limit for 2024 is $18,000 per giver per recipient.